Get This Report about Property By Helander Llc

Get This Report about Property By Helander Llc

Blog Article

Our Property By Helander Llc Diaries

Table of ContentsThe Definitive Guide for Property By Helander LlcNot known Details About Property By Helander Llc Property By Helander Llc Fundamentals ExplainedSome Known Questions About Property By Helander Llc.Get This Report on Property By Helander LlcThe Property By Helander Llc PDFs

The advantages of investing in realty are various. With well-chosen assets, investors can appreciate foreseeable capital, excellent returns, tax advantages, and diversificationand it's possible to take advantage of genuine estate to build riches. Considering buying actual estate? Right here's what you require to learn about realty advantages and why real estate is thought about a great financial investment.The benefits of spending in property consist of passive revenue, steady money circulation, tax obligation benefits, diversity, and utilize. Realty investment company (REITs) use a method to purchase actual estate without having to have, run, or financing buildings - https://soundcloud.com/pbhelanderllc. Capital is the take-home pay from a genuine estate investment after mortgage repayments and business expenses have been made.

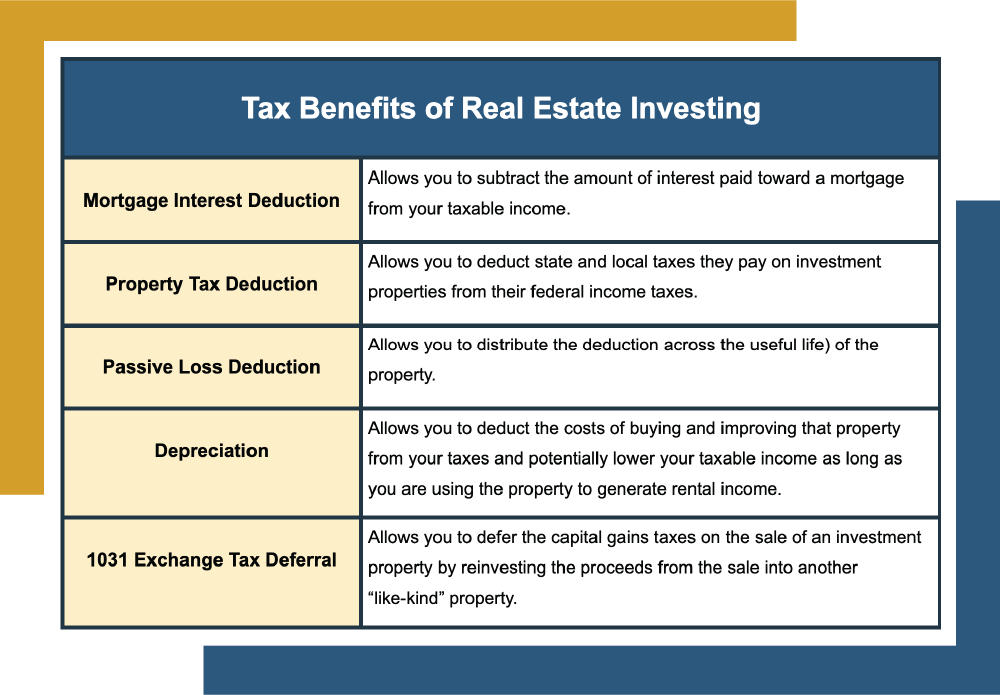

In numerous situations, cash money flow just strengthens over time as you pay down your mortgageand develop your equity. Investor can benefit from numerous tax breaks and reductions that can conserve cash at tax time. As a whole, you can subtract the sensible costs of owning, operating, and managing a residential or commercial property.

All About Property By Helander Llc

Real estate worths often tend to enhance over time, and with an excellent investment, you can turn an earnings when it's time to sell. As you pay down a home mortgage, you construct equityan possession that's component of your internet worth. And as you construct equity, you have the leverage to purchase even more residential or commercial properties and boost money circulation and wide range even extra.

Because genuine estate is a substantial property and one that can offer as collateral, financing is easily available. Property returns differ, depending upon variables such as location, asset class, and monitoring. Still, a number that lots of capitalists aim for is to beat the typical returns of the S&P 500what lots of people describe when they say, "the market." The rising cost of living hedging ability of property comes from the favorable relationship between GDP development and the demand genuine estate.

Not known Facts About Property By Helander Llc

This, in turn, converts right into higher resources values. Genuine estate has a tendency to keep the purchasing power of capital by passing some of the inflationary stress on to lessees and by integrating some of the inflationary pressure in the kind of funding appreciation - realtors in sandpoint idaho.

Indirect actual estate spending involves no direct ownership of a residential or commercial property or properties. There are several methods that possessing actual estate can protect versus rising cost of living.

Ultimately, properties financed with a fixed-rate loan will certainly see the relative quantity of the regular monthly mortgage payments fall over time-- for example $1,000 a month as a set payment will certainly become less troublesome as inflation wears down the acquiring power of that $1,000. Typically, a key residence is not thought about to be a realty financial investment since it is made use of as one's home

All About Property By Helander Llc

Also with the help of a broker, it can take a few weeks of job just to locate the right counterparty. Still, property is a distinctive property class that's straightforward to understand and can improve the risk-and-return account of an investor's profile. By itself, realty offers money flow, tax breaks, equity structure, affordable risk-adjusted returns, and a hedge against rising cost of living.

Buying actual estate can be an exceptionally gratifying and rewarding venture, however if you're like a great deal of brand-new investors, you might be questioning WHY you ought to be purchasing actual estate and what benefits it brings over go to my site various other financial investment chances. Along with all the outstanding benefits that come along with spending in property, there are some disadvantages you require to think about as well.

Top Guidelines Of Property By Helander Llc

If you're seeking a means to purchase right into the property market without having to spend thousands of hundreds of dollars, examine out our buildings. At BuyProperly, we make use of a fractional ownership model that permits capitalists to begin with as low as $2500. An additional significant benefit of property investing is the capability to make a high return from buying, restoring, and marketing (a.k.a.

Our Property By Helander Llc PDFs

If you are billing $2,000 rent per month and you incurred $1,500 in tax-deductible expenses per month, you will just be paying tax on that $500 revenue per month (Sandpoint Idaho land for sale). That's a big difference from paying tax obligations on $2,000 each month. The revenue that you make on your rental for the year is taken into consideration rental income and will certainly be tired as necessary

Report this page